Wait or Act? The Smart Investor’s Guide to Rate Cuts and Real Estate

Navigating the Market for Optimal Investment

Get a Free Rate QuoteDecoding Rate Cuts and Their Impact on Real Estate

With potential rate cuts on the horizon, investors are pondering a crucial question: Wait or Act? This decision carries significant weight, as it can substantially influence returns in the real estate market. Understanding the dynamics of rate cuts, their historical impact, and the current market conditions is paramount for making informed investment choices. This guide provides insights to navigate these complexities.

Evolve Capital Lending is committed to offering personalized mortgage solutions, ensuring a variety of financing options are available to promote both homeownership and long-term financial stability. Knowing whether to wait or act is vital.

Understanding the Rate Cut Landscape

Rate cuts typically stimulate economic activity by making borrowing more affordable. In the real estate sector, this can translate to increased demand for homes, potentially driving up property values. However, the impact isn't always immediate or uniform. Factors like existing inventory, local economic conditions, and investor sentiment also play a significant role.

Key Considerations Before Making Your Move

Before deciding whether to wait or act, consider these crucial factors:

- Your Financial Situation: Assess your current financial standing, including your credit score, debt-to-income ratio, and available capital.

- Market Analysis: Conduct thorough research on the specific real estate market you're interested in. Look at trends in prices, inventory levels, and rental yields.

- Investment Goals: Define your investment objectives. Are you looking for short-term gains or long-term passive income?

- Risk Tolerance: Evaluate your comfort level with risk. Real estate investments can be subject to market fluctuations.

Scenarios to Consider: Wait or Act?

The best course of action depends on your individual circumstances and market conditions. Here are a couple of scenarios to consider:

- Scenario 1: If you're a first-time homebuyer with stable income and a good credit score, acting sooner rather than later may be advantageous to take advantage of lower rates.

- Scenario 2: If you're an experienced investor with a high-risk tolerance, waiting for further rate cuts could potentially lead to better deals, but also carries the risk of missing out on opportunities.

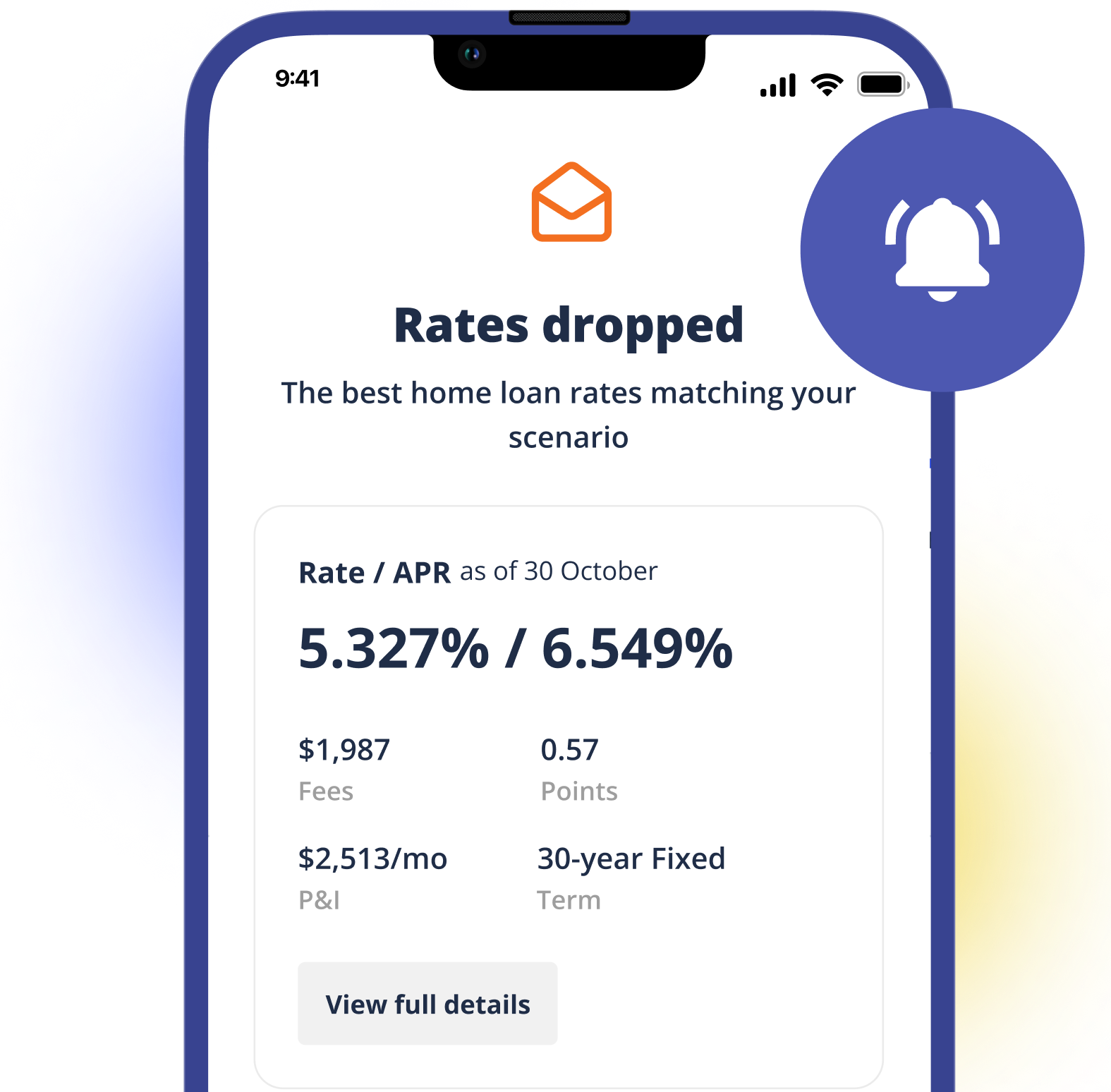

Don't Miss Out on Potential Savings

Stay informed when rates decrease! Enhance your rate shopping experience with our Price Drop Alert. This feature keeps you in the loop, instantly notifying you whenever rates go down. Don't let the perfect opportunity slip away.

Evolve Capital Lending: Your Partner in Real Estate Investment

Navigating the complexities of real estate investment requires expert guidance. Evolve Capital Lending offers personalized mortgage solutions tailored to your specific needs. Whether you're a seasoned homeowner, first-time buyer, or residential property investor, we provide the financing options you need to achieve your goals. Our services include:

- Home Purchase Loans

- Refinancing Options

- Jumbo Loans

- VA Home Loans

Ready to Make Your Move?

Whether you decide to wait or act, Evolve Capital Lending is here to help you make informed decisions and secure the best possible financing for your real estate investments. Our team is dedicated to providing personalized service and expert guidance every step of the way.

Get Your Free Custom Rate Quote Today!