Mortgage Myths in a Rate-Cut Economy: What’s True, What’s Not

Separating Fact from Fiction to Make Smart Home Loan Decisions

Get a Free Custom Rate QuoteNavigating the World of Mortgages in a Changing Economy

A rate-cut economy can feel like a whirlwind, especially when you're trying to understand mortgages. Are lower rates *always* better? Is now *really* the best time to buy? It's easy to get caught up in common mortgage myths. We're here to debunk those misconceptions and provide clarity, empowering you to make informed decisions. Understanding the realities of home loans during economic shifts can significantly impact your financial future, and we'll equip you with the knowledge to do just that.

With potential shifts in interest rates, it's crucial to discern between fact and fiction to make informed decisions. Don’t let these myths prevent you from securing the best possible deal for your needs. Whether you are a first-time homebuyer, looking to refinance, or considering an investment property, we'll provide clarity and expert guidance.

Myth #1: Lower Rates Always Mean It's Time to Buy

While lower interest rates can make homeownership more affordable, it's not the *only* factor to consider. Evaluate your financial situation, including your income stability, debt-to-income ratio, and long-term financial goals. A lower rate might mean lower monthly payments, but it doesn't negate the need for a solid financial foundation.

The Importance of Pre-Approval

Getting pre-approved is vital. It provides a clear understanding of how much you can borrow, giving you confidence and a competitive edge when making offers. It demonstrates to sellers that you are a serious and qualified buyer.

Myth #2: You Need a 20% Down Payment

This is a common misconception! While a larger down payment can help you avoid private mortgage insurance (PMI) and potentially secure a lower interest rate, many loan programs offer options with significantly lower down payments, such as FHA loans requiring as little as 3.5% down.

Adjustable vs. Fixed Rate Mortgages

Understanding the difference between fixed and adjustable-rate mortgages is crucial. Fixed-rate mortgages offer stability with consistent payments, while adjustable-rate mortgages may start lower but fluctuate over time. Consider your risk tolerance and long-term plans when choosing.

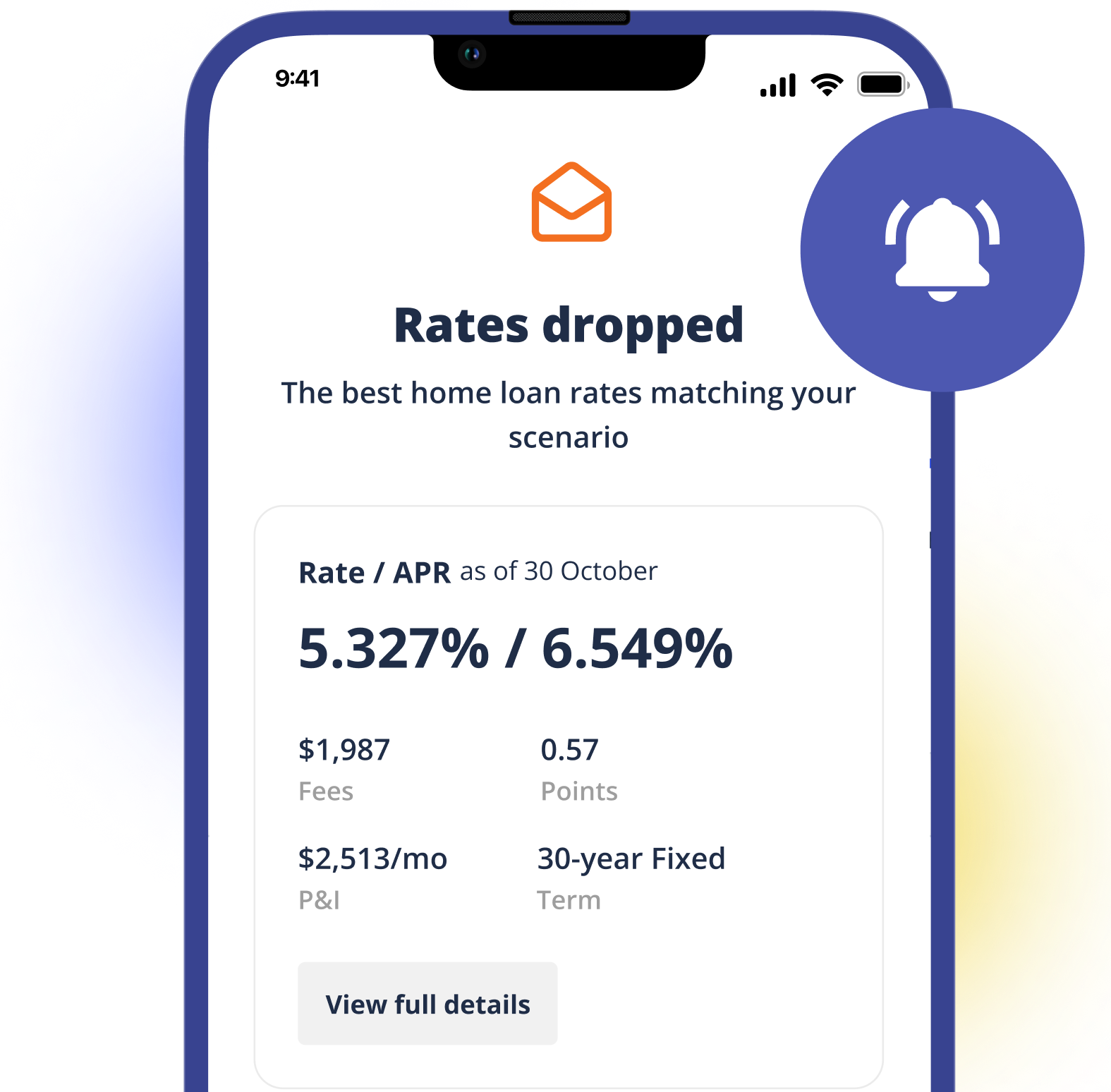

Myth #3: All Lenders Offer the Same Rates

Interest rates can vary significantly from lender to lender. It’s essential to shop around and compare offers from multiple sources to secure the most favorable terms. Don't settle for the first offer you receive. Doing your homework will save you thousands in the long run.

- Compare rates from multiple lenders.

- Consider all loan options.

- Factor in closing costs.

- Get pre-approved to strengthen bargaining position

Ready to Navigate the Mortgage Landscape with Confidence?

Don't let mortgage myths hold you back from achieving your homeownership dreams. Contact us today for personalized guidance and expert advice tailored to your unique situation. Let us help you separate fact from fiction and secure the best possible mortgage for your needs.

Apply Now