San Diego Home Purchase Loans: A Step-by-Step Approach

Your Guide to Securing the Perfect Home Loan in San Diego

Get a Free Rate QuoteNavigating the San Diego Home Loan Landscape

Purchasing a home in San Diego is an exciting venture, but the process of securing a home loan can seem daunting. Evolve Capital Lending is here to simplify the process with a clear, step-by-step approach. We understand the unique challenges and opportunities of the San Diego real estate market and are committed to providing personalized mortgage solutions tailored to your specific needs. From first-time homebuyers to seasoned investors, our team is dedicated to guiding you through each stage, ensuring a smooth and successful home buying experience. Learn how to navigate San Diego home purchase loans with expert guidance.

Step 1: Pre-Approval - Laying the Foundation

Before you even begin your home search, getting pre-approved for a mortgage is crucial. This involves submitting your financial details to a lender like Evolve Capital Lending. We'll review your credit history, income, debts, and assets to determine the loan amount and terms you qualify for. Pre-approval not only gives you a clear understanding of your budget but also strengthens your position when making an offer on a home.

Step 2: Loan Application - Formalizing Your Intent

Once you've found the perfect property and agreed on a purchase price, it's time to formally apply for a mortgage. This involves providing updated financial information and necessary documentation to your lender. Evolve Capital Lending will guide you through this process, ensuring all paperwork is completed accurately and efficiently.

Step 3: Rate Lock - Securing Your Interest Rate

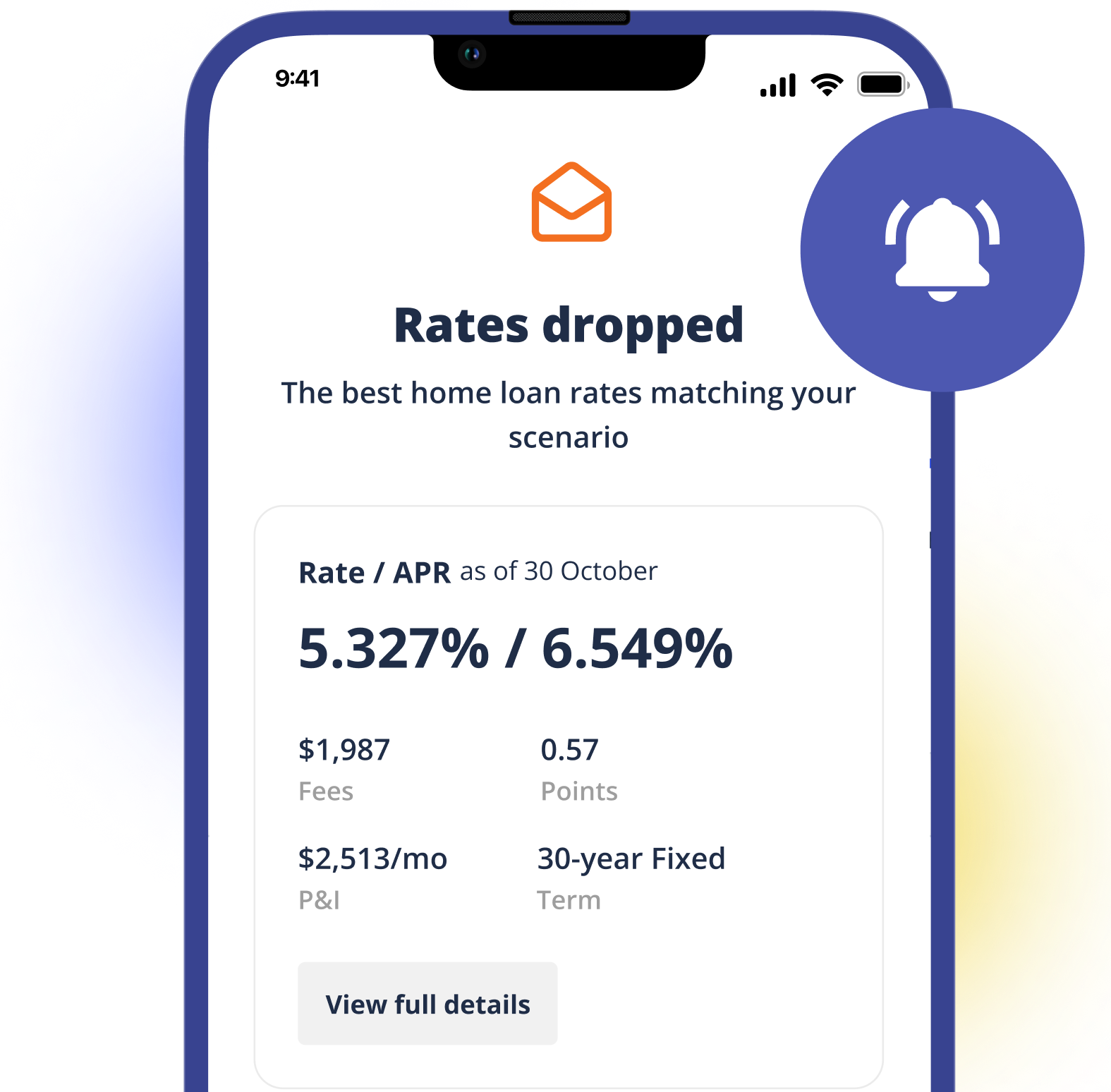

Locking in your interest rate is a critical step in the home loan process. When you lock a rate, you and your lender agree on a specific interest rate for your mortgage. This rate remains unchanged during the lock period, typically ranging from 15 to 60 days, providing stability regardless of market fluctuations.

Steps 4, 5 & 6: Processing, Underwriting, and Closing

These crucial final steps bring your home purchase to fruition. During loan processing, your lender verifies all provided information and may request additional documentation. Underwriting involves a thorough review of your documentation to assess the loan's risk. Finally, at closing, you'll sign documents, pay closing costs, and receive the keys to your new San Diego home!

Evolve Capital Lending: Your San Diego Home Loan Partner

Why choose Evolve Capital Lending for your San Diego home purchase loan?

- Personalized mortgage solutions tailored to your unique needs.

- Expert guidance through every step of the loan process.

- Competitive interest rates and flexible financing options.

- A commitment to client satisfaction and long-term financial stability.

Ready to Take the Next Step Towards Homeownership?

Contact Evolve Capital Lending today for a free consultation and discover how we can help you achieve your dream of owning a home in San Diego. Our team is ready to answer your questions and guide you through the process with ease.

Apply for a Home Loan Today