Navigating the Market: Are You Prepared if

Fed Cut Rates?

Position yourself for success.

Get a Free Rate QuoteUnderstanding Potential Fed Rate Cuts

The Federal Reserve's decisions on interest rates have a significant impact on the housing market. If as Fed Prepares to Cut Rates, it's essential to understand how this could affect your mortgage and financial strategy. Are you prepared for the potential shifts in the market? Lower rates could mean new opportunities for both homebuyers and homeowners looking to refinance. Evolve Capital Lending is here to guide you through these changes and help you make informed decisions.

Staying informed is your best defense, and proactive planning can put you in a prime position to capitalize on these changes. Whether you're a first-time homebuyer or a seasoned investor, understanding the nuances of rate cuts can make a substantial difference in your financial future. Evolve Capital Lending offers tailored solutions designed to fit your specific needs, ensuring you're always one step ahead.

Refinance Opportunities Await

If you already own a home, a Fed rate cut could create an opportunity to refinance your mortgage at a lower interest rate. This could translate to significant savings over the life of your loan. Consider refinancing if you're looking to reduce your monthly payments or shorten your loan term. Our team at Evolve Capital Lending can help you assess your options and determine if refinancing is the right move for you.

Benefits of Acting Quickly

Market conditions can change rapidly. Acting quickly to take advantage of lower rates can save you thousands of dollars in the long run. Don't wait until rates start to climb again. Stay proactive and explore your options with Evolve Capital Lending today. We provide custom rate quotes and personalized mortgage solutions tailored to your unique financial situation.

Home Purchase Power Increases

Lower interest rates mean increased affordability for potential homebuyers. If you're in the market to purchase a home, a Fed rate cut could stretch your budget, allowing you to afford a more desirable property. Take advantage of this opportunity to enter the market with confidence, backed by a tailored loan solution from Evolve Capital Lending.

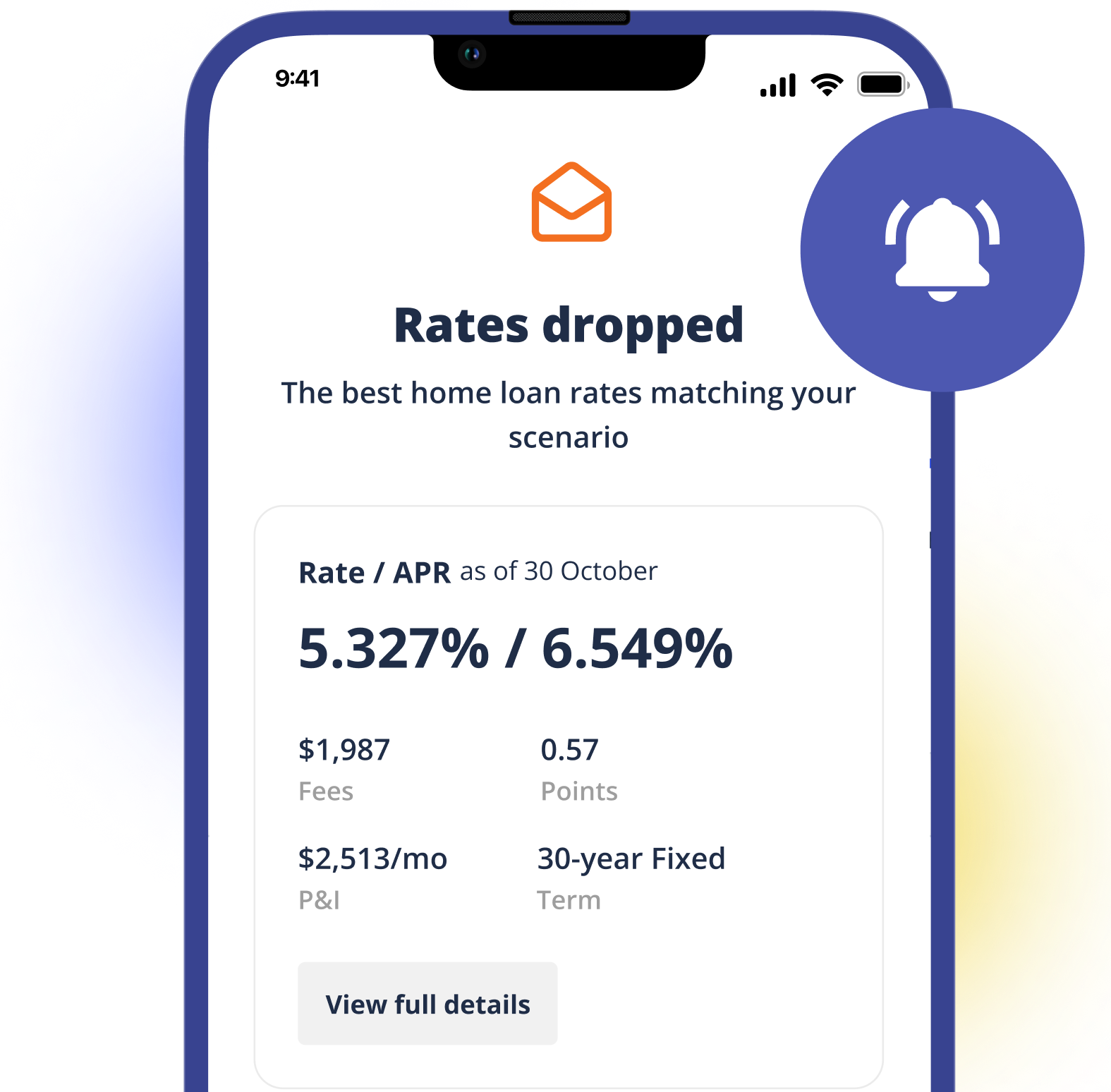

Stay Informed with Evolve Capital Lending Rate Watch

Don't miss out on potential rate drops. Enhance your rate shopping experience with our Price Drop Alert. This feature keeps you in the loop, instantly notifying you whenever rates go down. Stay informed and be ready to act when the opportunity arises.

Evaluate Your Mortgage Options

Are you prepared if as Fed Prepares to Cut Rates? Now is the time to review your current mortgage or explore new financing options. Consider the following:

- Assess your current interest rate and monthly payments.

- Compare rates from multiple lenders.

- Determine if refinancing aligns with your financial goals.

- Consult with a mortgage expert at Evolve Capital Lending.

Ready to Take the Next Step?

Don't leave your financial future to chance. Contact Evolve Capital Lending today to explore your mortgage options and position yourself for success in a changing market. Let us help you navigate the complexities of potential Fed rate cuts and secure the best possible outcome for your homeownership journey.

Get Started Today