Should I Wait Til Rates Are Lower to Invest in a New Home?

Navigating the Housing Market with Evolve Capital Lending

Get a Free Rate QuoteTiming Your Home Investment

Deciding whether to invest in a new home now or wait for potentially lower interest rates is a common dilemma. While predicting the future of interest rates is impossible, understanding current market conditions and your personal financial situation is crucial. Evolve Capital Lending is here to help you evaluate your options and make an informed decision. We provide tailored loan solutions designed to fit your specific needs, whether you're a first-time buyer or a seasoned investor. Before making any decisions, it's important to consider factors beyond interest rates, such as your long-term financial goals, housing market trends, and personal readiness to own a home.

Understanding the Current Market

Interest rates are just one piece of the puzzle. Home prices, inventory levels, and local economic conditions all play a role in determining the affordability and potential return on investment of a new home. A comprehensive analysis of these factors can help you determine if waiting makes sense or if opportunities exist even with current rates. Evolve Capital Lending stays informed on market trends to provide you with the most current and relevant advice.

The Importance of Pre-Approval

Getting pre-approved for a mortgage is a crucial first step, regardless of when you plan to buy. Pre-approval gives you a clear understanding of how much you can borrow, strengthens your negotiating power, and demonstrates to sellers that you're a serious buyer. Evolve Capital Lending's easy home loan process includes pre-approval, ensuring you're ready to act when the right opportunity arises.

Consider the Long-Term

Homeownership is a long-term investment. While lower interest rates can save you money over time, delaying your purchase might mean missing out on potential appreciation in home value. Evaluate your financial situation, consider your goals, and remember that waiting for the "perfect" moment might mean missing out on the right home for you.

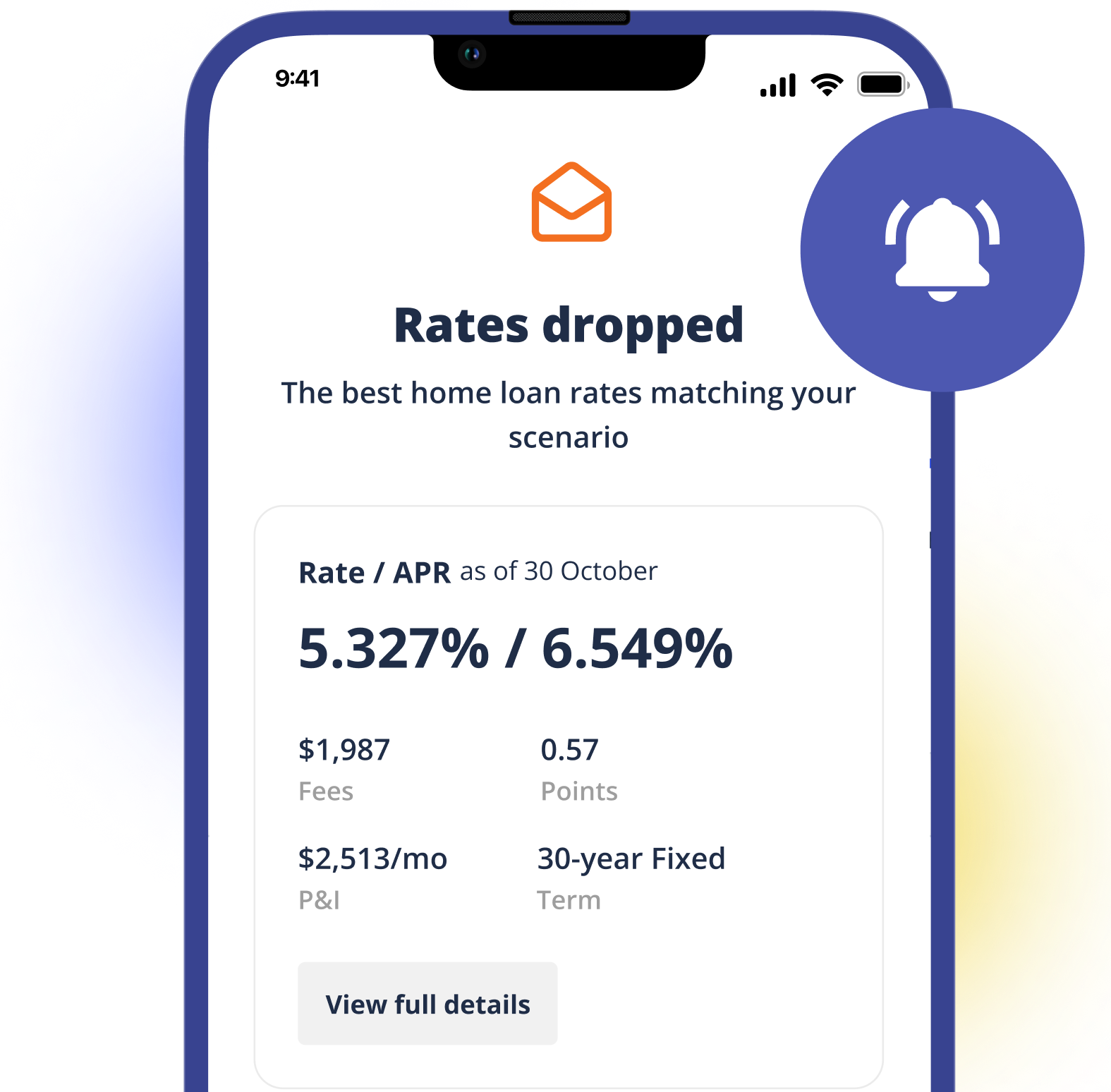

Stay Informed with Evolve Capital Lending's Rate Watch

Don't miss out on potential rate drops! Enhance your rate shopping experience with our Price Drop Alert. This feature keeps you in the loop, instantly notifying you whenever rates go down, allowing you to seize the opportunity to secure a more favorable mortgage.

Key Considerations Before You Decide:

- Your Financial Situation: Assess your current income, debts, and savings to determine affordability.

- Market Trends: Analyze home prices, inventory, and economic conditions in your desired area.

- Long-Term Goals: Align your home investment with your overall financial objectives.

- Opportunity Cost: Weigh the potential benefits of waiting against the risk of missing out.

Ready to Discuss Your Home Investment Options?

Contact Evolve Capital Lending today for a personalized consultation. We'll help you assess your situation, explore your financing options, and make an informed decision that aligns with your financial goals. Let us guide you through the home buying process with confidence.

Get Started Today