What Do Trillions in Foreign Investment and Rate Cuts Mean for You?

Navigating the Economic Landscape for Homeowners and Buyers

Get a Free Rate QuoteUnderstanding the Impact on Your Finances

The global economy is constantly in flux, and major shifts like trillions in foreign investment and interest rate cuts can significantly impact your personal finances, especially when it comes to homeownership. At Evolve Capital Lending, we're committed to helping you understand these changes and make informed decisions.

Foreign investment flowing into the U.S. can stimulate economic growth, potentially leading to job creation and increased wages. Simultaneously, rate cuts by the Federal Reserve can lower borrowing costs, making mortgages more affordable. But how do these factors directly affect you?

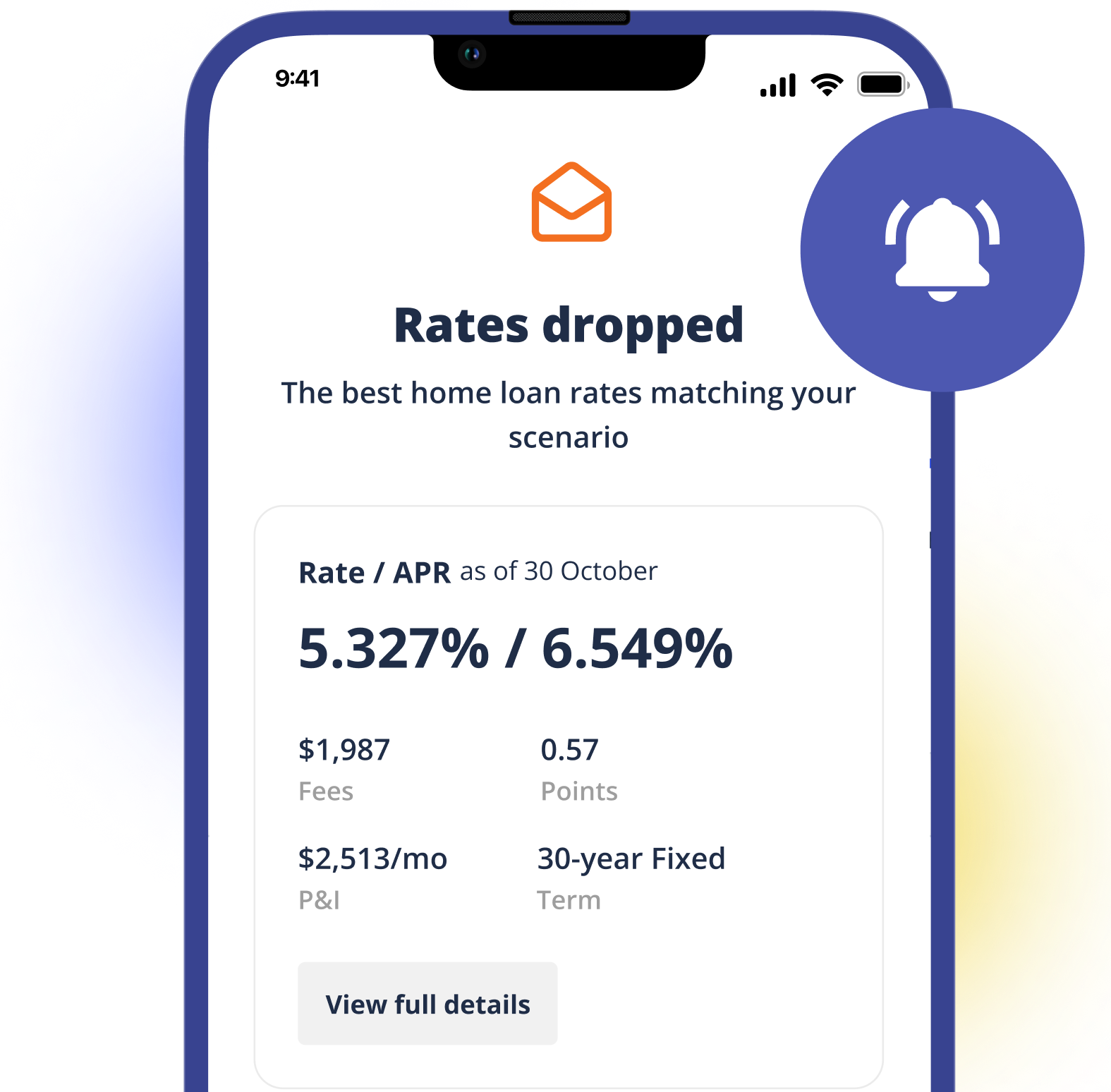

Lower Mortgage Rates: A Golden Opportunity?

Rate cuts typically lead to lower mortgage rates, making it a great time to consider buying a home or refinancing your existing mortgage. Lower rates translate to lower monthly payments, freeing up cash for other financial goals. Whether you're a first-time homebuyer or a seasoned homeowner, understanding these opportunities is crucial.

Foreign Investment and the Housing Market

Increased foreign investment can boost the housing market by driving up demand, particularly in certain regions. While this can be beneficial for homeowners looking to sell, it can also increase competition for buyers. Understanding local market trends and working with a knowledgeable lender like Evolve Capital Lending is key to navigating this landscape.

The Ripple Effect on the Economy

Trillions in foreign investment can create a ripple effect throughout the economy, influencing job growth, consumer spending, and overall financial stability. These factors can indirectly impact your ability to afford a home and manage your mortgage payments. Staying informed about these broader economic trends is essential for long-term financial planning.

Are you ready to take advantage of the current market conditions?

Evolve Capital Lending is here to guide you through every step of the process, from pre-approval to closing. Let us help you secure the best possible mortgage rate and achieve your homeownership dreams.

Your Next Steps to Financial Success

Consider these key actions to benefit from the current economic climate:

- Review Your Mortgage Options: Explore refinancing possibilities to lower your monthly payments.

- Get Pre-Approved: Understand your borrowing power before searching for a home.

- Stay Informed: Keep up-to-date with economic news and market trends.

- Consult with Experts: Work with a trusted lender like Evolve Capital Lending to navigate your options.

Ready to Explore Your Home Loan Options?

Don't miss out on the potential benefits of foreign investment and rate cuts. Contact Evolve Capital Lending today to discuss your mortgage needs and secure a brighter financial future.

Get Started Today