Explore Your San Diego Mortgage Refinancing Options

Lower your monthly payments and achieve your financial goals.

Is Refinancing Right for You?

Navigating the world of mortgages can be complex, especially when considering refinancing. If you're a homeowner in San Diego, understanding your San Diego Mortgage Refinancing Options is crucial for making informed financial decisions. Whether you're aiming to secure a lower interest rate, shorten your loan term, or tap into your home's equity, the right refinancing strategy can make a significant difference. Our team at Evolve Capital Lending is dedicated to providing personalized solutions tailored to your unique needs. San Diego's dynamic real estate market demands a nuanced approach, and we're here to guide you every step of the way. Let's explore how refinancing can help you achieve your financial aspirations and build long-term stability.

Benefits of Refinancing Your Mortgage

Refinancing your mortgage can provide numerous advantages, especially in a vibrant market like San Diego. Here are some key benefits to consider:

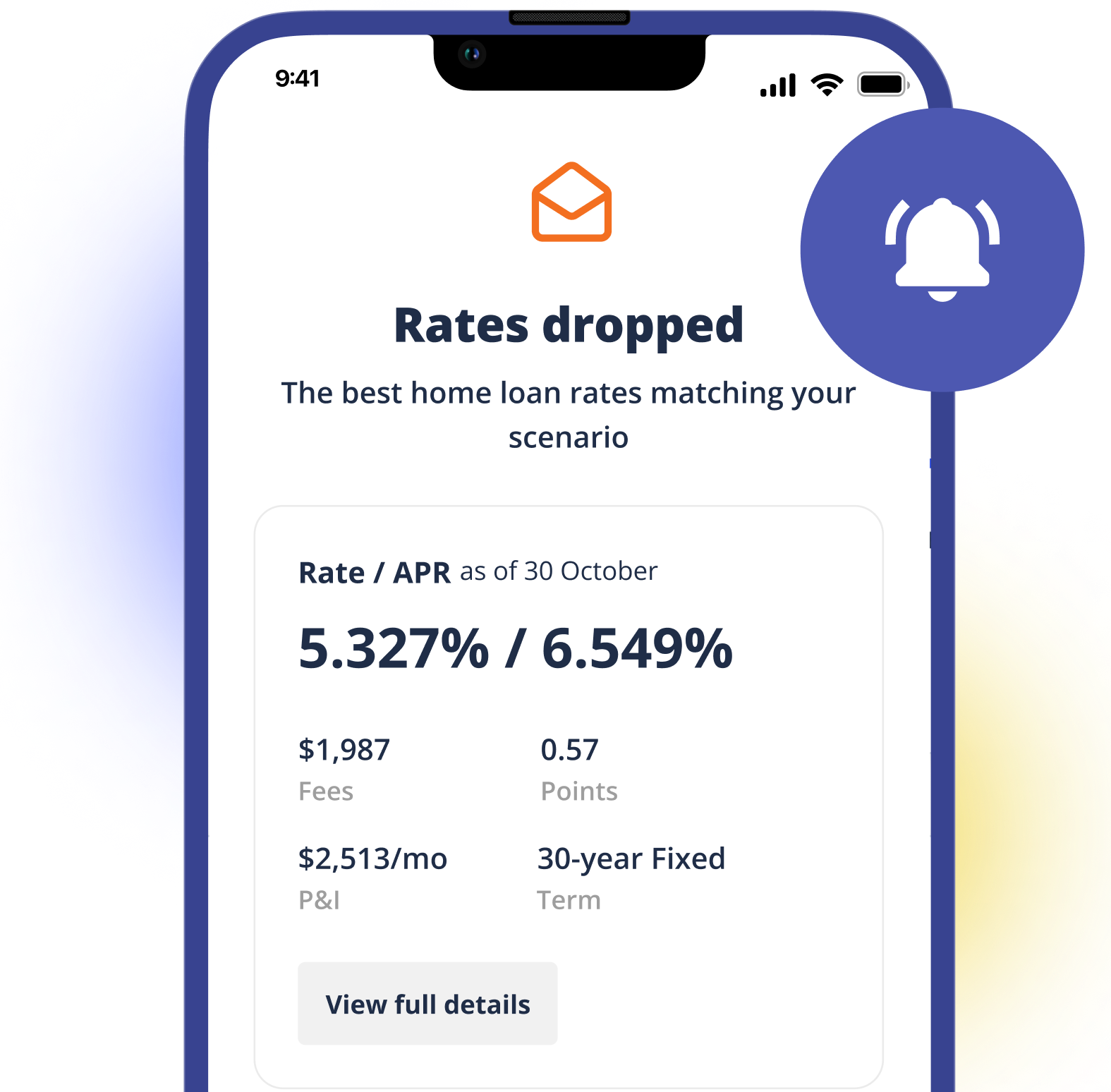

- Lower Interest Rate: Potentially reduce your monthly payments.

- Shorter Loan Term: Pay off your mortgage faster.

- Access Equity: Use your home's value for improvements or debt consolidation.

- Change Loan Type: Switch from an ARM to a fixed-rate mortgage for stability.

Understanding Your Refinancing Options

Choosing the right refinancing option depends on your individual circumstances and financial goals. Common types of refinancing include rate and term refinance, cash-out refinance, and streamline refinance. Evolve Capital Lending offers tailored guidance to help you navigate these options and select the best fit for your needs. We'll analyze your current mortgage, assess your financial situation, and present you with clear, understandable solutions.

The Refinancing Process

The refinancing process typically involves several key steps:

- Application: Submit your financial information to a lender.

- Appraisal: Have your home's value assessed.

- Underwriting: The lender reviews your application and documents.

- Closing: Finalize the loan and sign the necessary paperwork.

Expert Advice for San Diego Homeowners

Refinancing can be a smart financial move, but it's essential to work with a knowledgeable and experienced lender. Evolve Capital Lending is committed to providing San Diego homeowners with expert advice and personalized service. We'll answer your questions, address your concerns, and help you make the best decision for your future.

Serving the San Diego Community

We proudly serve homeowners throughout San Diego County, including:

- Carlsbad

- Chula Vista

- Coronado

- Del Mar

Ready to Explore Your Refinancing Options?

Contact us today to learn more about San Diego Mortgage Refinancing Options and start your journey toward financial freedom. Our team at Evolve Capital Lending is here to help you every step of the way.