Evolve Capital Lending is committed to offering personalized mortgage solutions, with a strong emphasis on meeting the specific needs of their clients, whether they are seasoned homeowners, first time buyers or residential property investors. The Evolve Capital Lending team integrates innovation and a client first mentality, ensuring a variety of financing options are available to promote both home ownership and long term financial stability. We are excited to mention a majority of our clients are referrals.

Client reviews from around the internet.

Before beginning your home search, it's essential to get pre approved for a mortgage. This step involves submitting your financial details to a lender, who will then review your credit history, income, debts, and assets to determine the terms of your loan.

After receiving pre approval, you can start shopping for a home within your budget. Once you find the right property and agree on a purchase price, you'll formally apply for a mortgage, providing updated financial information and necessary documentation.

When you lock in a rate, you and your lender agree on a specific interest rate for your mortgage. This rate will not change during the lock period, which typically ranges from 15 to 60 days, regardless of market fluctuations.

Your lender will then begin processing your application, which includes verifying all the information you've provided. They may request additional documents or clarifications. During this stage, an appraisal of the property is conducted to determine its market value.

In this crucial phase, the underwriter thoroughly reviews all documentation and assesses whether to approve or deny the loan based on factors like your credit score, debt to income ratio, and the property's value. This step determines the lender's financial risk.

The final step is closing, where you'll sign the necessary documents to finalize your mortgage. At this stage, you'll typically pay closing costs, and the ownership of the property will be transferred to you, making you the new homeowner.

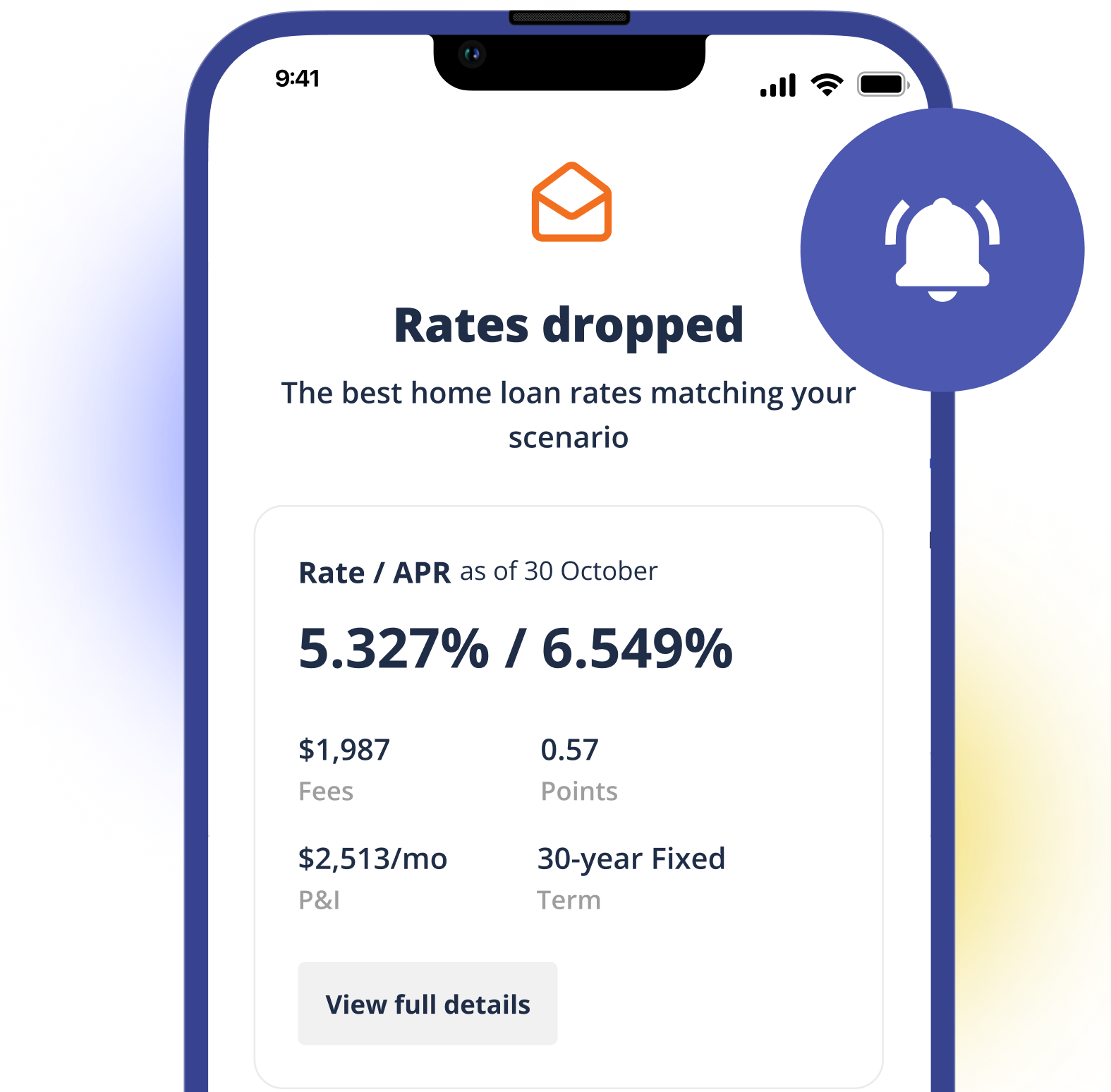

Don't miss out on a rate drop enhance your rate shopping experience with our Price Drop Alert. This feature keeps you in the loop, instantly notifying you whenever rates go down.

Clear, expert answers to the most common home loan questions, helping you navigate your journey to homeownership with confidence.

The minimum credit score depends on the loan type. For conventional loans, it's typically 620. FHA loans require a score of 580 or higher, though some lenders may accept lower scores with larger down payments.

The down payment depends on the loan type. Conventional loans usually require 5-20%, FHA loans require as little as 3.5%, and VA loans often require no down payment.

A fixed-rate mortgage has a stable interest rate for the life of the loan, ensuring predictable monthly payments. An ARM has an interest rate that may change after an initial fixed period, potentially lowering initial payments but increasing future risks.

Closing costs typically range from 2-5% of the loan amount and include fees for appraisal, title insurance, lender fees, and more. These costs are often discussed upfront and can sometimes be negotiated or rolled into the loan.

The amount you can borrow depends on your income, credit score, debt-to-income ratio, and the type of loan. A pre-approval process can give you a clear idea of your borrowing p

Yes, self-employed individuals can qualify for a home loan. You'll need to provide proof of income, usually with tax returns, bank statements, and other financial documents from the past 1-2 years.

PMI is required for conventional loans if your down payment is less than 20%. It protects the lender in case of default but adds to your monthly payment. Some loans, like FHA loans, have similar insurance requirements.

The typical closing process takes 30-45 days, but this can vary based on the loan type, lender, and how quickly you provide required documents.

FHA loans are backed by the Federal Housing Administration and have lower credit score and down payment requirements, making them ideal for first-time buyers. Conventional loans are not government-backed and often have stricter requirements but may offer more flexibility for those with good credit.

The pre-approval process involves submitting financial documents, such as income statements, tax returns, and credit reports. The lender reviews your information and provides a conditional loan amount, giving you an edge when making offers on homes.

Your DTI ratio compares your monthly debt payments to your gross monthly income. Lenders use it to assess your ability to repay the loan. A lower DTI (below 43%) is ideal for qualifying for most loans.

Yes, you can qualify for a home loan with student loan debt. Lenders will consider your total debt, including student loans, when calculating your DTI ratio. Making consistent payments and maintaining good credit can improve your chances.

You can lock in an interest rate during the loan application process. The lock period typically lasts 30-60 days, depending on the lender. This protects you from rate increases while your loan is being processed.

Escrow is an account managed by a third party that holds funds for property taxes and homeowner’s insurance. Your lender collects these payments as part of your monthly mortgage and pays them on your behalf to ensure timely payments.

If you miss a payment, you may incur late fees, and it could impact your credit score. Contact your lender immediately to discuss options, such as a repayment plan or loan modification, to avoid foreclosure.

A jumbo loan is a mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). They are typically used for high-value properties and often have stricter credit and income requirements.

Points are upfront fees paid to lower your mortgage interest rate. One point equals 1% of the loan amount. Buying points can save money over time, especially if you plan to stay in the home long-term.

Yes, many loan programs allow you to use gift money for your down payment. You may need to provide a gift letter from the donor stating that the funds are a gift, not a loan, and meet specific lender requirements.

Refinancing after 15 years on a 30-year mortgage requires careful consideration, as your payments now primarily reduce principal rather than interest. While a lower rate of 3.5% could save money, refinancing resets the amortization schedule, shifting more payments toward interest, especially with a 30-year loan. Opting for a 15-year refinance preserves your remaining term and maximizes savings. Key factors to weigh include closing costs, monthly payment reductions, and total interest savings. If the break-even point for recouping refinancing costs aligns with your financial goals, such as lowering payments or paying off the loan faster, refinancing could be worthwhile.

If you have any questions, please share your name, email, and phone number with us, and we will respond promptly.